The NSW Hardware Ecosystem

Table of Contents

PHYS311 Project Report

Ming Han, Yang Su Ahn

Executive Summary

The goal of this particular project was to map out the existing hardware manufacturing ecosystem in the wider Sydney region and to provide wider exposure of these companies to startups, small-to-medium enterprises (SME’s) and even large corporations, so Australian companies can utilise domestic suppliers for sourcing and services that are commonly being outsourced overseas. Through extensive searching using online search engines and informal interviews with SMEs and startup companies, we have been able to create a living database of 362 companies. While this database is nowhere near the size that it was initially intended to be, it is a worthwhile starting point for future projects as a foundation that others can refer to and build upon.

We have also uncovered several issues that have been mentioned as a commonality by startups and SMEs. The commonality pertains to detractors and poor experiences these companies have had with domestic service providers that they have not encountered with their overseas counterparts. These issues include the lack of and infrequency of communication between producers and customers. Furthermore, the turnaround times for both quotes and actual products are often tremendously slow, as well as other factors such as pricing, quality and dis-interest in low volume and/or custom orders.

Despite these detractors, what was surprising to the authors is that many local startups and SMEs are definitely more than willing to pay higher prices to use domestic service providers and manufacturers if the turnaround times and communication issues can be improved. The enumerable benefits that come from close proximity means that if any issues do arise, they can be addressed in a timely fashion instead of relying on emails to overseas companies. With this in mind, if other authors wish to continue with this particular endeavor, we would advise building upon the existing database and expanding the search radius to include startups and SME companies as well as a wider range of service providers who offer a broader range of capabilities.

Aim

The aim of this project was to map out the hardware ecosystem of New South Wales, Australia by creating a database of hardware manufacturers/service providers and the products/services they provide.

Motivation

In recent years, state governments have started to increasingly place emphasis on boosting the Australian economy by increasing funding to the hardware startup space. As a result of this, many incubators and accelerator programs aimed at helping startups have come into existence to facilitate and streamline development of companies and thrust them into the market as a fully- fledged competitor. A side effect of this seems to be that when startups come to the prototyping stage for their products, they prefer to go overseas for the manufacturing side of their business. It appears as though startups are not placing much effort in looking at domestic suppliers due to deeply ingrained stereotypes associated with pricing and efficiency. Instead, these companies are going through overseas channels or supply chains that have connections with the accelerator/incubator space who usually conduct production several orders of magnitude larger than what is necessary for startups.

When considering this to be the case, the overall goal of boosting the economy in Australia falls flat as manufacturing businesses that can offer the same service domestically are being sidelined by the very customers they were meant to expand with. Subsequently the fact that this kind of event was occuring attracted attention from entrepreneurs, government-funded science entities and other accelerator and incubator programs. Namely, these people and entities realised the problem that was taking place in the hardware startup space and jointly decided to act and come up with a solution to resolve the situation. This is where the motivation of this project stems from. The entities involved; Bitscope Design, Lindfield Collaboration Hub in CSIRO and Western Sydney University, came to the conclusion that a public database of domestic hardware manufacturers and service providers would give these companies the exposure they need to attract business from startups, SME’s and even large corporations so they can hopefully source their products domestically as much as possible.

Approach/Methodology

The first phase of the project was to perform a Google search of manufacturers and service providers related to hardware. This phase was aimed at increasing the number of companies on the database regardless of quality of service. Due to the nature of companies we are trying to find, a majority of businesses are searchable through key phrases like manufacturer or hardware provider however, there were many instances where a company that was listed as a service provider had no means of contact listed on the online domain and instead was only searchable but not contactable. These companies were mostly family run, small scale service providers that functioned on the basis of word of mouth. As such, while they were added to the larger living document database, the services that they supplied remained unclear.

Keeping this in mind, we had to change our approach to finding niche suppliers and manufacturers. So while we kept going with the search engine approach, we also conducted informal interviews with resident startups and SME’s within CSIRO’s facilities to get a better grasp of what these companies do, what they require in terms of their services and what kind of experiences they’ve had with both domestic and overseas suppliers. This approach yielded relatively good results as we were able to access several small databases kept by the SME’s that we were able to incorporate into the larger database.

We also spoke with other accelerator and incubator programs like Cicada Innovations and Boost design with the goal of getting some information on what their experiences with domestic suppliers were like. These talks also revealed that there still exists some level of distrust between other accelerator and incubator programs. Some of these accelerators gave us very little information about their supply chains and instead yielded some information about why they were going overseas for their manufacturing needs. While some of the responses did not contribute to the living document we have been working on, it gave us some much needed context behind the stereotypes associated with outsourcing overseas.

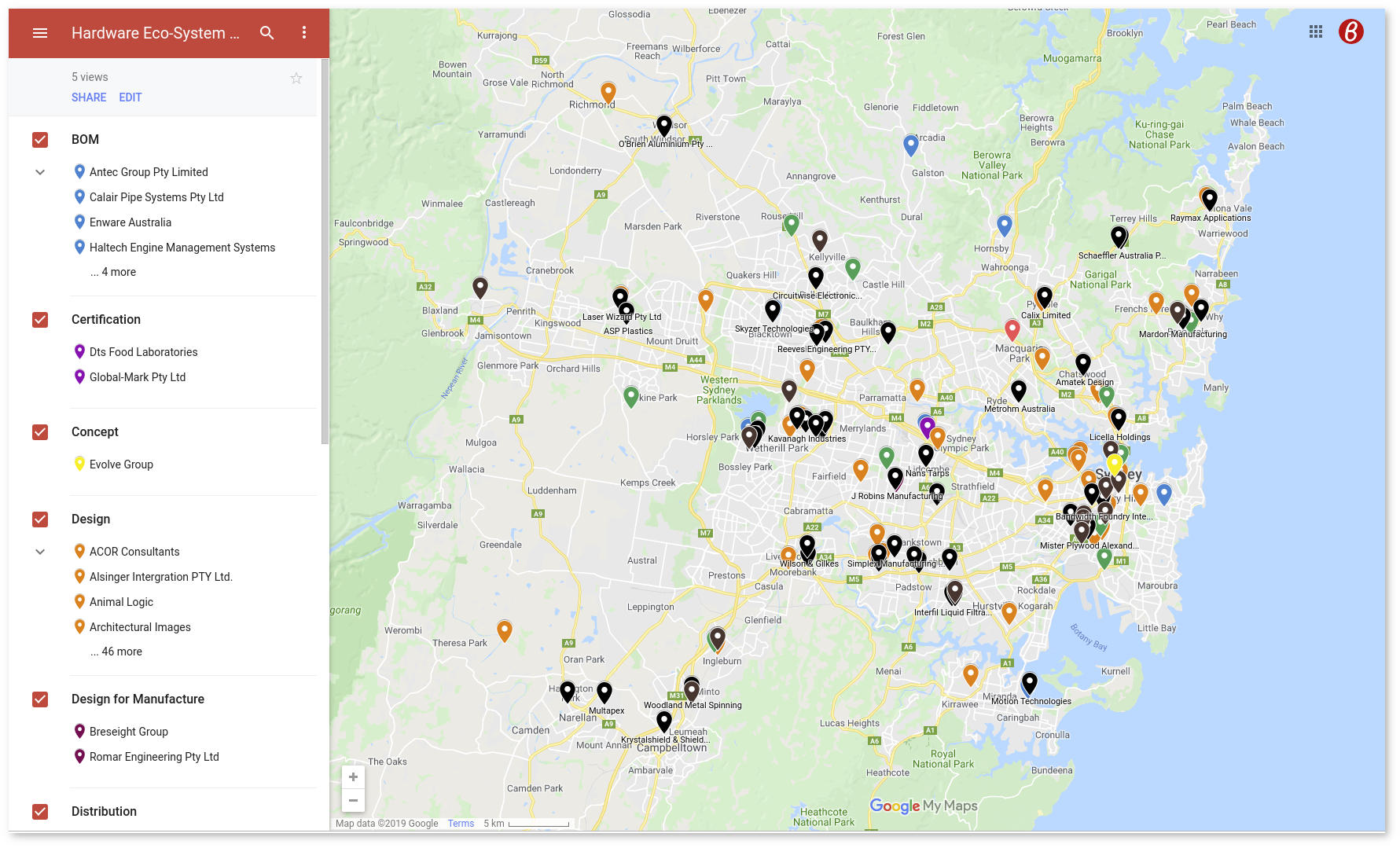

Map

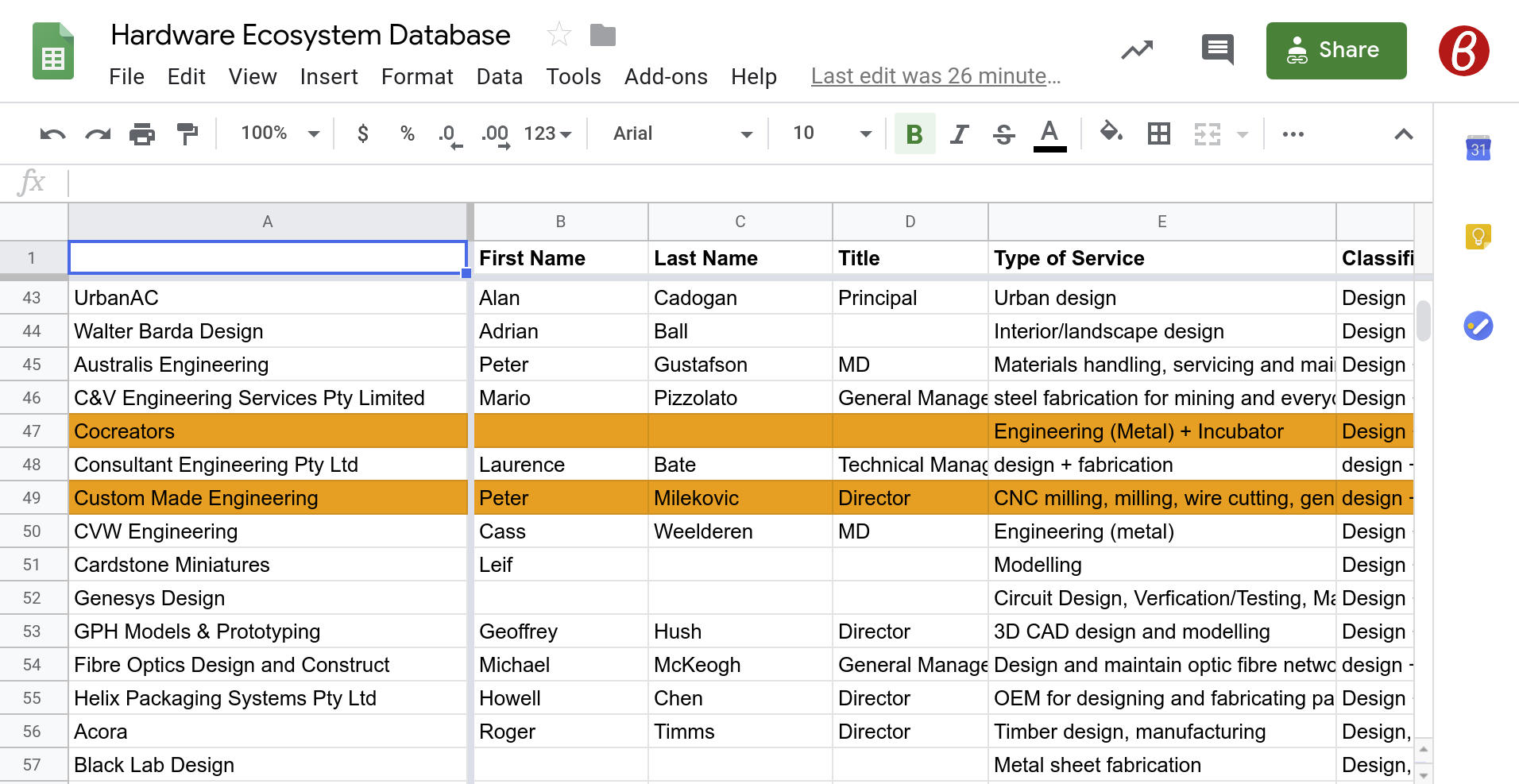

Database

Results

From the search engine findings and small databases we were able to access, we were able to compile a list of 362 companies in total. From those companies, we categorised them into different classifications depending on their service type. While most of the companies fell under one specific type, some companies, especially those bigger corporations offered more than one service. This caused some unexpected issues as the living document had some very specific taxonomy that was assigned to each category of service provider. Companies that offered more than one service type had to be organised by their most dominant service whereas other companies offered services that was not part of the taxonomy.

Taking this into account, the document is organised into service type with the most abundant being fabrication, prototyping and sourcing. These types are mainly businesses that focused on specific prototyping like 3D printing and laser cutting or sourcing rare components so they can act as a parts vendor. Fabrications can be considered semi-manufacturing types where they can fabricate complex parts with final assembly being done by either the buyer or other provider. The map was created after the list was finalised as a way to show the spatial distribution and proximity of the database businesses. It is meant to be used in conjunction with the database so that SMEs can check their own location and also see where the nearest service provider is. This takes into account the geographical advantage that businesses have with proximity to SMEs being a large factor in potential customer decisions.

Qualitative Results

In various interviews with startup companies and SME’s, we came across some common reasons as to why they use overseas hardware suppliers (manufacturers and service providers) instead of domestic/local ones.

Communication

One of the most common reasons that startups and SME’s stated regarding why they choose overseas suppliers was the speed and efficiency of communication. A common experience that companies have had with domestic suppliers is that quotes can take 2 or 3, even up to 6 weeks. Overseas suppliers will commonly respond within a day or two of enquiry and subsequently be proactive about adjustments or alterations that are required from the initial design/specifications.

Manufacturing Times

The time taken for products to be manufactured on average appeared to be much shorter from overseas suppliers than domestic ones. Most companies that we interviewed experienced very quick deliveries from overseas suppliers. Particularly for startup companies, speed of processes is an extremely important consideration, leading them to opt for suppliers with shorter turnaround times.

Price

Generally, the cost of manufacture has been found to be cheaper overseas. Many startups, particularly self-funded ones, operate on a limited budget and thus, the price is another crucial factor in the choice of supplier.

Quality of Products

There have been mixed reviews regarding the experiences startups and SME’s have had with the quality of products manufactured from overseas suppliers. The type of product was a big factor for this difference. Simple products such as plastic casings were produced to an adequate quality. However, companies that placed orders for complex or products requiring high precision have had experiences where the product/component was not built accurately to the specifications and had to be remanufactured.

Order Volume

Companies have been turned down by manufacturers and service providers due to the volumes of their orders. Many of the larger manufacturers are reluctant to interrupt their existing manufacturing processes to complete a small batch or a custom order from a startup/SME. Local manufacturers/service providers still wanted

In many of our interviews, we found that many Australian startup companies and SME’s are highly interested in using local hardware suppliers if they are viable. One of the reasons for this is the value of working face-to-face with the supplier. Companies have experienced moments where new ideas and better methods have been developed through face-to-face conversations with the people with whom they are working. Another reason stated was that if a supplier that was in close proximity to the company was used, an employee of the company could frequently visit or even be stationed at the supplier. This would help ensure the quality of the product before it is produced and received.

Discussion

There were many limitations and challenges that arose during the course of this project. One of these challenges was the limited amount of time allotted for the scope of the project. The given 100 hour timeframe was insufficient to map out the entire hardware ecosystem of NSW. A longer timeframe would have allowed for further methods of research to be conducted, such as phone calls to reach out to potential interested parties and physical site visits, that would have greatly increased the depth of information about each company that could be ascertained. Another challenge that we faced was the lack of digital presence or footprint of many of the hardware manufacturers and service providers. Much of the research relied on companies having websites, listings on Yellow Pages or White Pages, or Google business listings. Companies that did not have any of these were left undiscovered, and even for such companies that were discovered from interviews, little to no further details about them were collected.

A surprising hurdle that surfaced was that not all of the interviewees (hardware companies, startup companies and SME’s) shared the collaborative mindset that was the motivation behind this project. During some of the interviews, we found a reluctance to share names of specific suppliers and clients, which demonstrated a competitive mentality rather than a collaborative one. We imagine that this mindset is not shared among all members of the of incubators and accelerators community, given how the startup space is currently fairing. That being said, most of the SMEs and accelerators we spoke to were more than willing to share their supply chains and networks.

The results of this project can be viewed as a small preview of what is possible with much more investment of time and effort. Although the database is not as comprehensive as we originally envisioned, it is a significant initial attempt, and can serve as a starting point for other similar projects to work on in the future.

Future Research

This project is a relatively new endeavour and much more research needs to be done in this field to fully map out the ecosystem of hardware manufacturers and service providers that exists in Australia. Being a living document, the database is available to any interested party or stakeholder to collaborate to its development in the future. The potential benefits of research in this field are both significant and diverse. They include a more comprehensive database of hardware companies in Australia and greater efficiency and collaboration between hardware startup companies and service providers.

The most immediate next step from this project would be to continue to find and add the remaining hardware manufacturers and service providers in NSW. In addition to this, gathering more detail about each manufacturer or service provider such as pricing, turnaround times and capacity to process small or large order volumes, would make the database more informative and useful for the startup companies looking for a supplier. Some companies also do not fall into a single classification of the taxonomy, and so further research is required on these companies to fully understand the extent of their services.

As the hardware ecosystem of NSW is continually being mapped out, similar work can be undertaken in the other states of Australia, with the ultimate goal being a national database of all of the hardware manufacturers and service manufacturers in the country. Having such a national database would allow a much more complete picture of the state of the hardware ecosystem of Australia, its capabilities, possibilities and shortcomings to be grasped.

Prototyping and manufacturing is not the only process for which hardware startup companies seek or need external help. Other areas include design, business structure, intellectual property, software development/integration, marketing and distribution. Another direction of future research would be to map out the domestic service providers in these fields so that startup companies have an accessible database of a variety of different services. This would increase the exposure of even more domestic companies, and potentially allow startup companies to outsource even more of their work to domestic suppliers rather than to overseas ones.

As well as mapping out the hardware manufacturers and service providers, mapping out the hardware startup companies would also be a highly useful endeavour. Once a visual map of the hardware manufacturers and service providers is complete, a similar database of startups could be compiled and used to create a map of these companies also. The two maps can then be overlayed and this may provide insight into either key regions of potential central hubs of intense collaborative activity, or obvious gaps, such as high numbers of startups but little to no manufacturers, or vice versa.

Conclusion

The aim of this project was to map out the hardware ecosystem of NSW. It was found that many domestic hardware manufacturers and service providers do exist, but much of the outsourcing of manufacturing is done overseas, most commonly due to pricing and time constraints. Further investigation is required to build a comprehensive database of all of the hardware manufacturers and service providers’ capacity/willingness to meet the needs of startup businesses.

References

| Title | The NSW Hardware Ecosystem |

|---|---|

| Permalink | LGMT6CU5/ja0qbhhiqujf6o98 |

| Authors | Ming Han <ming.han4@students.mq.edu.au> |

| Yang Su Ahn <yang-su.ahn@students.mq.edu.au> | |

| Map | Google Map |

| Database | Google Sheet |

| Project | Home Page |

| Share | Linked In |

| Join | Mailing List |

| Revision | Changes |

| 03 | Database updates now accepted (request permission when visiting it). |

| 02 | Linked in Google Map and Sheet, fixed permissions preventing public access. |

| 01 | Report published. Map created. |